Pfizer-Novo-Metsera dispute: lessons to learn on biotech-pharma M&A deals

What happened?

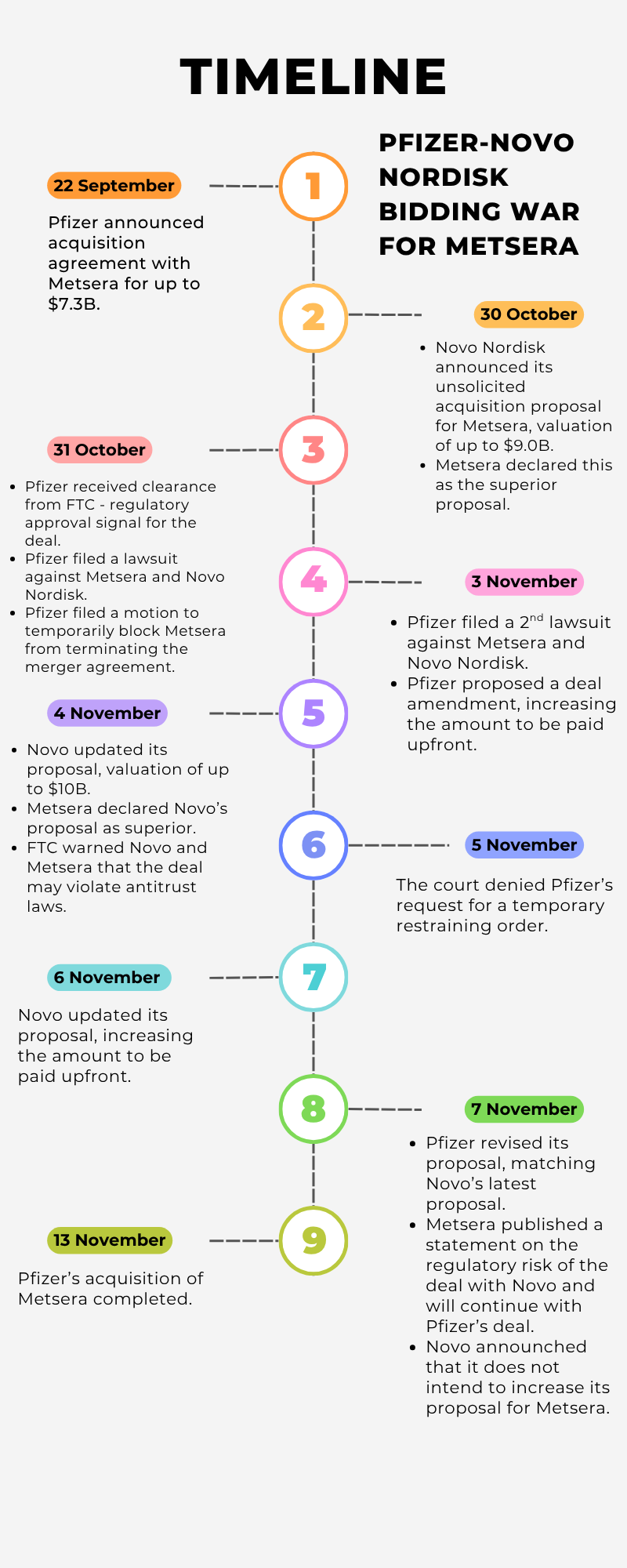

In the past few months, pharma giants Pfizer and Novo Nordisk have been competing for the right to acquire Metsera, a biotech with a robust obesity pipeline. Winning could mean building a stronger foothold in the obesity market, especially for Pfizer, whose own drug development efforts have not been successful1. The bidding war, which ended on 7 November when Pfizer proposed a valuation of US$10 billion, was riddled with lawsuits, counterclaims, and accusations. It is also a good case study to learn about mergers & acquisitions (M&A) deals in the biopharmaceutical industry.

Technical Lessons

Deal structuring

All the deals proposed in this case study were structured similarly: paying $X amount to acquire all outstanding shares of common stock upfront, then paying additional amounts contingent on achieving certain clinical and regulatory milestones.

Common stock gives its holders voting rights, but they are paid last when the company undergoes liquidation. This contrasts with preferred stock, whose holders have no voting rights but are paid before common stockholders during liquidation. Outstanding shares are all the shares held by shareholders of a company. Thus, the pharma giants were proposing to buy all the controlling shares of Metsera.

Contingent Value Right (CVR) is a financial tool that entitles existing shareholders in an M&A deal with additional payments, contingent upon achieving certain future milestones2. CVR is popular in pharmaceutical/biotech deals due to the high-stakes uncertainties often involved. A clinical/regulatory milestone could significantly alter the value of the target company. Thus, CVR enables both acquirers and targets to receive fairer prices.

Stages in an M&A deal

In its deal proposal statements, Novo Nordisk stated that it will pay to purchase 50% of Metsera’s non-voting preferred stock at signing. This could be confusing when the company also said that it will purchase 100% of Metsera’s common stock. Untangling this confusion requires an understanding between “signing” and “closing”.

“Signing” the M&A agreement merely confirms that both parties will abide by the terms laid out in the contract3.

“Closing” happens when the merger/acquisition has been completed and the target company is now officially owned by the acquirer3.

The interim period between signing and closing is to carry out due diligence, including obtaining the required regulatory approvals. The purpose of due diligence is to identify any potential risks, ensuring that the deal is sound4.

Thus, upon signing the agreement, Novo will purchase 50% of Metsera’s non-voting preferred stock. This will assure Metsera of Novo’s commitment during the interim process, without giving away control. 100% outstanding common stock will only be transferred once the deal is closed.

Regulation on M&A

Throughout the bidding war, the issue of regulatory risks and anti-competition violations were continuously brought up.

Antitrust laws exist to prevent a reduction in competition and the emergence of monopolies in markets, which could harm consumers. Many countries require companies to file for regulatory approval before an M&A deal can be carried out, usually when the size of the companies/transaction exceeds certain thresholds. In the U.S., reviewing merger filings is the responsibility of the Federal Trade Commission (FTC).

As Novo Nordisk is currently holding a large share of the obesity drug market, its acquisition of obesity biotech Metsera has a high risk of regulatory rejection.

Public Image Management

The case showed how companies attempt to manage their public images by releasing statements and announcements. Pfizer and Metsera regularly released statements upholding their stances throughout the dispute. For Pfizer, it was insisting that Metsera could not declare Novo’s proposal as superior and calling Novo’s deal anti-competitive. For Metsera, it was rejecting the legitimacy of Pfizer’s arguments and alleging Pfizer of trying to litigate its way to pay a lower price. Novo also released a statement affirming the company’s belief that its proposal does not violate anti-competition laws, in spite of the FTC’s warning5.

A Strategic Lesson

Metsera’s success at boosting its valuation by over $2.5 billion showed the importance of knowing your value and taking the risk as a target company. By leveraging Novo’s proposal, Metsera risked losing Pfizer’s deal if Pfizer values Metsera at less than what Novo offered. Without Pfizer, Metsera would be left with only Novo, whose proposal has a higher risk of being rejected by the FTC. Nevetheless, Metsera continued to trust its own valuation and pressed on. An important lesson for biotech companies in M&A negotiations.

References

-

Waldron J. Pfizer’s embattled obesity program loses another GLP-1 over poor data and strong competition. Available at: https://www.fiercebiotech.com/biotech/pfizers-embattled-obesity-program-loses-another-glp-1-drug. Accessed 12 November 2025.

-

Segal T. What Are Contingent Value Rights (CVRs)? Meaning, Types, and Risks. Available at: https://www.investopedia.com/terms/c/cvr.asp. Accessed 13 November 2025.

-

Joanknecht. Signing versus Closing: The Difference with Mergers and Acquisitions. Available at: https://joanknecht.com/signing-versus-closing-the-difference-with-mergers-and-acquisitions/. Accessed 13 November 2025.

-

CFI. Due Diligence. Available at: https://corporatefinanceinstitute.com/resources/valuation/due-diligence-overview/. Accessed 13 November 2025.

-

Novo Nordisk. Novo Nordisk will not increase its proposal to acquire Metsera, Inc. Available at: https://www.novonordisk.com/content/nncorp/global/en/news-and-media/news-and-ir-materials/news-details.html?id=916454. Accessed 13 November 2025.